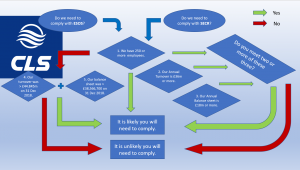

Below is a simple flowchart that sets out whether or not you are likely to be affected by ESOS phase 2 or SECR:

- SECR superseded the Carbon Reduction Commitment (CRC). ESOS is in its 2nd period.

SECR takes the place the reporting requirements of the CRC, which ended on 31st March 2019. However, SECR required annual reporting whereas ESOS is four yearly (current ESOS deadline is 5th December 2019. Both contains significantly different reporting requirements.

- The scope of compliance has changed

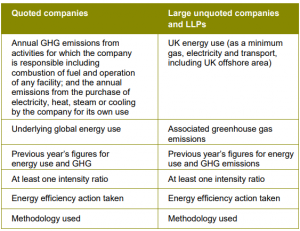

Both total energy and fuel consumption (TEC) and carbon emissions must be reported. These must include, as a minimum, the sum of electricity, gas and transport fuel expressed in units of consumption (e.g. kWh), and Scope 1 emissions along with an intensity ratio and information relating to energy efficiency activities. SECR became live for most companies on 1st April 2019. Whenever your annual return date starts, at the very least, you need to be collecting your energy and fuel data from this date.

- Were you exempt from the CRC?

If you were exempt from CRC, you may well NOT be exempt from SECR. The new regulation delivers a significant increase in the number of mandated companies. With only around 2,000 CRC participants (many from the public sector that are not affected by SECR). SECR will mandate reporting for up to 15,500 companies, including those mandated to ESOS. SECR regulations apply to:

UK incorporated Quoted companies (as defined at s.385 of the Companies Act 2006) also known as Plcs.

UK registered unquoted (Private/Ltd) companies that satisfy any two (or more) of the following criteria:

- More than 250 employees.

- Annual turnover greater than £36 million.

- Annual balance sheet total greater than £18 million.

Large Limited Liability Partnerships (LLPs) that meet two or more of the above criteria.

Large unregistered companies that are required to produce directors’ reports under the Large and Medium-sized Companies and Groups Regulations 2008.

- Disclosure against other frameworks might make this easier

If you previously participated in the CRC, Energy Savings Opportunities Scheme (ESOS), Climate Change Agreements (CCA) Scheme or EU Emissions Trading Scheme (ETS) reporting, as well as other voluntary environmental reporting frameworks, you may already have a reasonable system in place to deal with much of SECR.

You should get acquainted with the full SECR requirements and identify any required changes in advance or contact us to assist.

- Reporting must be:

- Relevant

- Quantitative

- Accurate

- Complete

- Consistent

- Comparable

- Transparent

- Reporting must Include:

- Action i Intensity ratios

- Action ii Setting a base year (typically 1 April 2019 to 31 March 2020 if this is your companies house reporting year)

- Action iii Setting a target

- Action iv Verification & assurance

- Action v Your upstream supply chain

- Action vi Downstream impacts

- Action vii Business continuity and environmental risks

- SECR must also include:

- SECR requires yearly reporting

Companies need to disclose their energy and carbon information in their Directors’ Report as part of their annual filing to Companies House. This is intended to make environmental reporting a normal part of business disclosures.

- SECR is designed to be streamlined

If this is the first time that your company has been obligated, this may all seem daunting. However, if you have been reporting under CRC, ESOS or the EU ETS, then this regulation can bring significant efficiencies in collecting and reporting data. Alignment with other frameworks avoids the need for a whole new data collection process.

- Unlike the CRC, this is not a stealth tax.

The CRC was originally designed with environmental benefit at its core, this was subverted by Treasury to form a tax. SECR has no such ambition. It is designed to assist companies to understand and then act to reduce their carbon emissions through looking at reducing energy, fuel and fleet use.

- Begin to plan now.

If you are not sure if you need to comply, take the time to review the regulations and assess whether you are mandated or not. If you must report for the first time, you will need to set up processes for data collection and calculation in order to ensure you are compliant. We would be happy to assess your data and can assist you to establish whether or not you are obligated (no charge). Gathering your data together at this point would, if assessed and thoroughly considered, help the company whether or not it is obligated. Contact us to find out more.

- This forms part of UK Government’s Clean Growth Strategy.

As was forecast for ESOS, a 1% saving through energy efficiency across all mandated UK ESOS companies has capacity to save £1.6bn. The aim of this strategy is to help more business and industry to improve their energy productivity . This system should allow for greater comparison of energy and emissions reporting and reductions among large organisations.

- Good and bad news.

The removal of the CRC will be popular amongst CRC participants. However, Climate Change Levy (CCL) costs will rise to compensate for the reduced tax revenue into Treasury. Unfortunately, companies will feel the impact of CCL rates increasing significantly. In the long term, companies using large amounts of natural gas are likely to be heavily affected; Gas costs are expected to increase year on year to equalise with electricity CCL rates by 2025. The better news is that the energy and fuel efficiency benefits that can be delivered from the Energy Savings Opportunities Scheme (ESOS) can more than offset these costs. According to recent national surveys, 61% of companies have not yet acted on their ESOS Phase 1 recommendations. For some this is because many were not actionable, All of our customers have acted on at least two of their recommendations.

- Like ESOS, SECR is an opportunity to make savings that will improve your profitability

Few regulations targeted at business provide an opportunity to make savings. By complying and acting on the findings of your data assessment, energy savings opportunities can be as high as 45% of your energy costs for a company tackling this for the first time. If you spend 20% of your outgoings on energy and fuel, then a 10% saving on this is a 2% improvement in your profit line. By the same token, a 45% of energy savings would amount to 9% improvement in profits, without selling another widget! CLS Energy have made up to 47% savings against some of our customers spend!

If you have any questions about the new regulations and next steps for you, get in touch or call our energy and fleet specialist, Alan Asbury directly on 07954 702792.